2025-01-27 · Npercent Capital AG

Early-Stage VC Valuations: US vs. Europe

Contrasting early-stage valuation dynamics between the US and Europe, and what it means for VC founders, investors, and long-term value creation.

At @Npercent Capital, as part of our scouting for interesting ventures for our members, we always find it fascinating to track early-stage VC metrics across geographies – particularly by contrasting key valuation measures between the US and Europe, and within Europe itself.

US & Europe compared

According to @Carta, in the US, median angel, pre-seed, and seed valuation estimates (via SAFE post-money val. caps) currently sit at $9m, $11.5m, and $21m respectively.

This boggles the European mind, as – according to @PitchBook – the Old Continent’s comparable pre-money valuations at the pre-seed/seed stages sit at a meagre €3.1m ($3.7m).

In fact, one needs a European Series A-B (median €20m [$24m]) to reach valuation levels comparable to a US seed stage – and this even after a staggering +24.5% increase in median European Series A-B valuation between 2024 and 2025!

Why the gap?

The US-Europe VC valuation gap thus remains an abyss.

Many factors explain this, including:

- Relative capital abundance

- Anchored cultural norms in valuations

- Differing growth and macroeconomic expectations

- Structural attractiveness of certain jurisdictions over others (e.g. via their legal systems)

All these factors also play into the relative bargaining power of investors and founders in terms negotiations, which is a very important determinant of valuations at the earliest stages of VC funding.

Taking a page from Silicon Valley

Despite all this, an “Americanization” of sorts is under way.

While data for Switzerland is hard to come by, we have experienced a staggered convergence of valuation norms towards the US apex, which is aided by an increasing interest of US investors into the Swiss VC ecosystem (a historic 30%+ of total deal size in 2025, according to @Startupticker.ch and @SECA).

After the 2020–21 VC boom, US pre-seed/seed valuations and round sizes never really corrected, and are now in fact reaching their historical peaks – a pattern which is being repeated across most if not all European geographies, albeit still with a significant US-Europe “gap”.

“Value” in venture capital

Early-stage valuations are the result of a delicate dance between founders and investors – but their importance to terminal returns might be huge, hence the need to calibrate them correctly.

It is extremely tough to talk about “value” in early-stage VC investing, but the 2021 VC vintage provides a clear warning: median net IRR in the US for that valuation boom year is now only barely positive, with a very unencouraging trajectory, according to @PitchBook data.

As in anything, then – price matters.

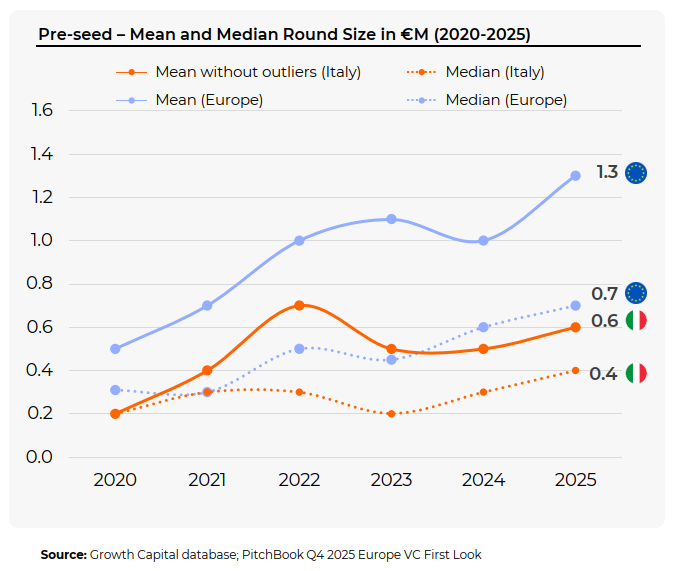

Pockets of “value” probably exist in European early-stage VC, with the Southern periphery still presenting more moderate valuations compared to the EU “core”, despite robust total deal size growth over the past 2 years (@Growth Capital, @Italian Tech Alliance).

Sources

- Carta, State of Startups 2025 (Dec. 2025)

- Pitchbook, European VC Valuations Report Q3 2025 (Nov. 2025)

- Startupticker.ch / SECA, Swiss Venture Capital Report 2025 – Update (Jul. 2025)

- Growth Capital / Italian Tech Alliance, Venture Capital Report Italy Q4-25 & FY-25 (Jan. 2026)